Focal points of the EU Commission's Banking Package / Regulatory - Der Blog zum Bankaufsichtsrecht / PwC Deutschland

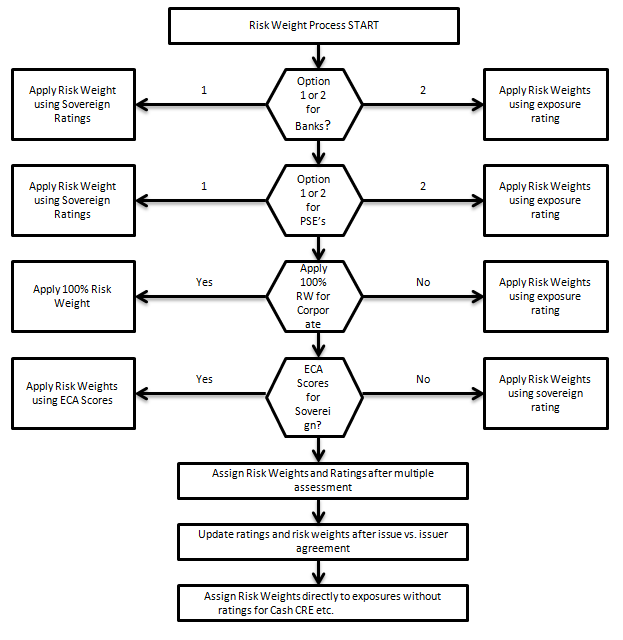

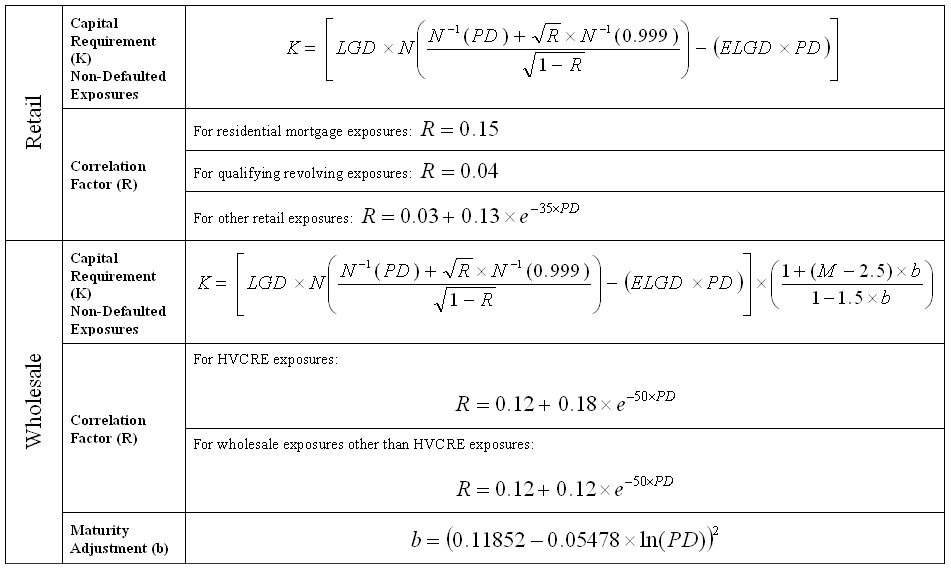

Basel II Capital Accord - Notice of proposed rulemaking (NPR) and supporting Board documents - Draft Basel II NPR - Part IV - Risk-Weighted Assets for General Credit Risk

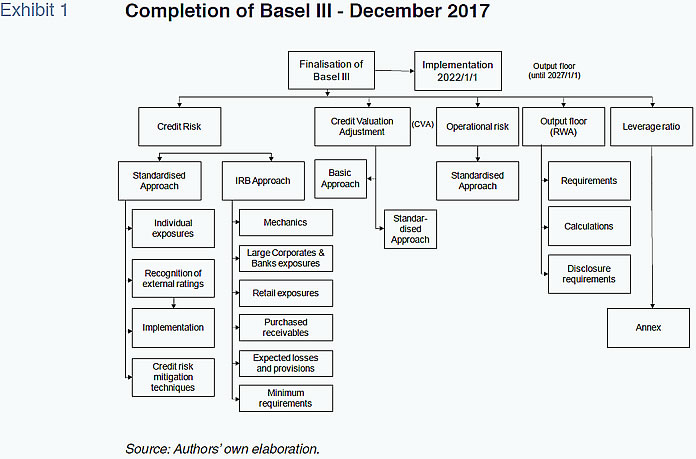

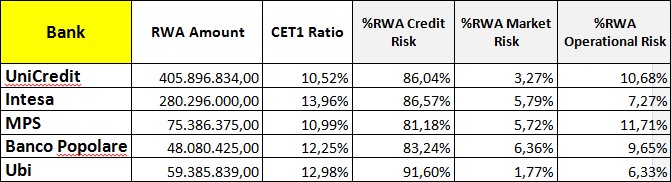

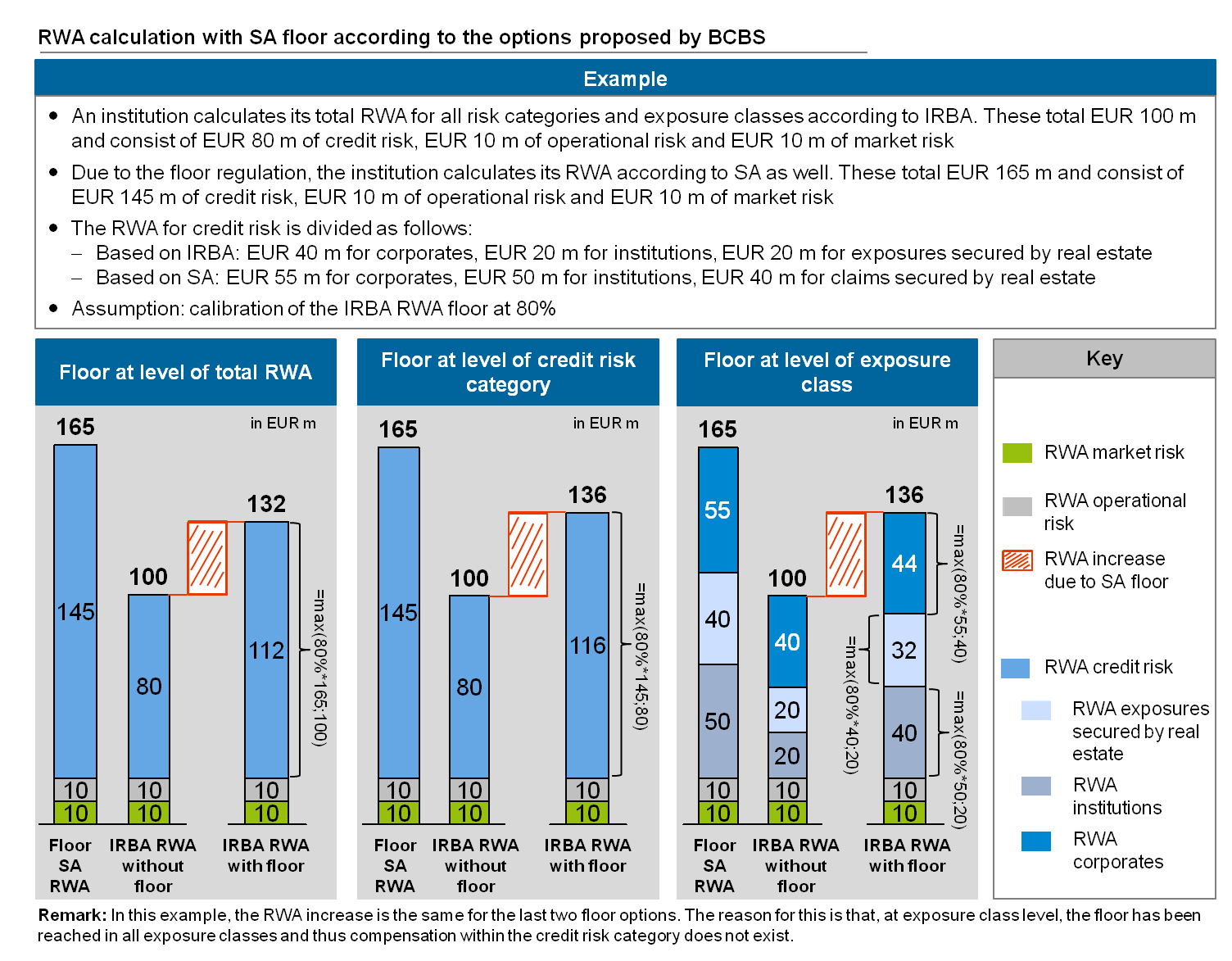

Revised standardised approach for credit risk — How the new floor regulations reduce capital ratios of IRBA institutions | BankingHub

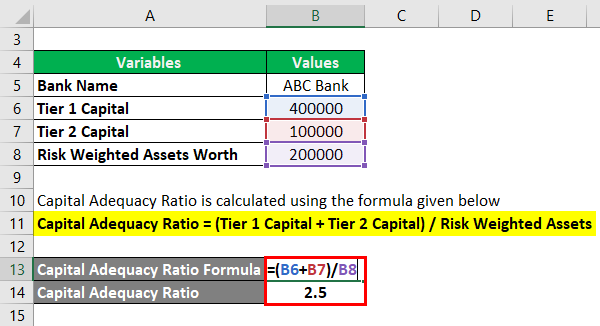

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework